Detroit has been called everything from the Motor City to the Arsenal of Democracy to the bankrupt City to the City that simply refuses to die.

Yet in 2025, Detroit has transformed itself into something else entirely: a place where history, affordability, and renewal converge.

While other metropolitan areas have sky-high prices and slow growth, Detroit offers rare entry points with plenty of upside potential for the new generation of investors flocking to the city with dollar signs in their eyes.

Here, home prices remain well below the national median, but appreciation rates are climbing faster than the Midwest average.

If you want fix-and-flip margins, cash-flow rentals, or long-term appreciation, Detroit is a market to watch.

Here are five of the hottest neighborhoods to keep an eye on in the Detroit area in 2025.

1. Regent Park (East Side, 48205)

Tucked away on Detroit’s far east side is Regent Park, a classic Detroit neighborhood full of charming touches.

Think brick ranches, tidy bungalows, and colonials on tree-lined blocks.

Years ago, this little pocket of the city went unnoticed, but that’s changing fast.

Here, the median sale price is around $104,000, representing an increase of more than 60% year over year, with an average time on market of about 61 days, which is down from more than 80 in 2024. With an entry point still below $100,000, Regent Park presents a better opportunity than many fix-and-flip areas.

What makes Regent Park so attractive is its affordability, upward momentum, and close proximity to shopping and commuter routes, all within walking distance of Gratiot Avenue and Eight Mile – perks that have gone a long way to draw in working-class families and young renters alike.

As far as best strategies in Regent Park go, think long-term buy-and-hold rentals.

2. Warrendale (West Side, 48228)

Next up is Warrendale, a 48228-zip code hot spot.

Sitting adjacent to Dearborn and Dearborn Heights, Warrendale is seeing a strong spillover demand now more than ever before.

Here, the median sale price is approximately $72,500, an increase of about 20% from a year ago, while the median listing price is about $90,000, with renovated homes fetching far more.

As far as architecture, think sturdy brick homes in ranch and bungalow styles.

Warrendale has long been popular with landlords. It’s only just now seeing a revival as a fix-and-flip mecca. Homes here typically go for around $50K-$70K, are renovated on tight budgets, and resold for around $120K-$150K, with demand in Warrendale particularly high given the fact that it’s an area close to schools and shopping corridors.

Top strategies here: Scooping up underpriced flips in need of cosmetic rehab as well as overlooked smaller multifamily rentals.

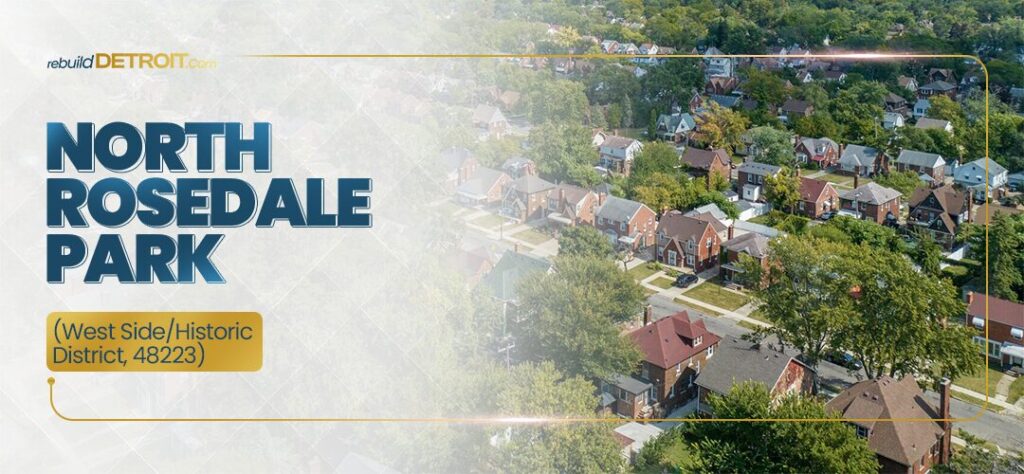

3. North Rosedale Park (West Side/Historic District, 48223)

If Regent Park and Warrendale represent affordability, North Rosedale Park represents prestige.

Large Tudor and colonial homes line this west-side neighborhood in a nationally recognized, historic district.

It’s also one of the few neighborhoods in Detroit where most residents are homeowners rather than renters.

In 2025, North Rosedale Park saw a median sale price of nearly $319,000, up an impressive 65% year-over-year, with homes in this charming neighborhood selling in as little as 21 days compared to more than a year on the market in previous years.

Fully renovated properties in North Rosedale Park typically fetch between $300,000 and $400,000, depending on size and quality of finishes, highlighting the neighborhood’s strong demand and appreciation potential.

And the neighborhood has more than just curb appeal.

A private community house for lively gatherings, parks, and an active neighborhood association help retain the area’s historic charm.

In short, North Rosedale Park is one area where the demand is always high and turnover is low, making it the kind of place many families choose to stay for generations.

Top plays here: High-end flips for seasoned investors or buy-and-holds for appreciation. There are higher entry costs – often $200,000 just to buy – so this is not an area for those shopping on a tight budget. However, the margins are real: investors buy distressed properties, renovate with quality finishes, and resell them into a market where homes with these kinds of bones are rare.

4. Morningside (East side, 48224)

Morningside, situated just across Mack Avenue near upscale Grosse Pointe, is one Metro neighborhood that has been quietly heating up for years. It’s slowly becoming one of Detroit’s hottest east-side neighborhoods for homeowners and investors.

Prime location is the main factor driving Morningside’s growth.

It’s the perfect community for young professionals and first-time buyers who grew up in Grosse Pointe and want to be near family who cannot afford the $300K-$400K price tags there, a great stepping-stone considering it offers fully renovated homes for $200K-$250K.

Best strategies for Morningside?

Think fast turn flips with high end finishes.

Homes around Mack Avenue command the highest values, although properties farther into the neighborhood can still be bought affordably and renovated for profit.

Landlords also report healthy rental demand, but the biggest wins are on the resale side.

5. Bagley (Northwest Side, 48221)

For investors in 2025, Bagley is one of Detroit’s crown jewels, offering gorgeous Tudors, colonials, and brick homes right near the University District and the Detroit Golf Club with a thriving community vibe and close proximity to universities making it a huge draw for homeowners and students.

As of July 2025, Bagley’s median sale price sits at around $199,000, with listing prices averaging $209,000 and renovated homes often exceeding $300,000.

Despite this strength, recent trends show a slight dip in sale prices, presenting a timely opportunity for value-minded investors to enter the market.

Bagley is one of Detroit’s most stable neighborhoods, one where many homes have original architectural details that make them easily resalable.

It’s one Detroit neighborhood where investors are purchasing duplexes like crazy, turning them back into single-family homes and listing them at premium values.

Best strategies here: bigger renovation projects, student rentals, and long-term appreciation are all at play, but expect a high ceiling, as comps regularly top $300K.

Why Detroit’s Real Estate Market is the Move in 2025

It isn’t just these neighborhoods making waves.

Citywide, Detroit is showing the world that recovery is more than just a pipe dream – it’ is ‘s capable of being measured:

Citywide, Detroit’s median listing price hovers around $85,000—still far below the U.S. average but steadily climbing as demand grows.

Backing this upward trend, more than $1 billion has been invested in affordable housing over the past five years, signaling not just recovery, but long-term stability for the city’s housing market as a whole.

Major projects like Ford’s Michigan Central Station in Corktown and Henry Ford’s $3 billion expansion in New Center are fueling job growth and drawing a new flock of residents into the city.

All of this has led to homes in Detroit’s most desirable neighborhoods selling far quicker than in previous years, a clear sign of rising demand and tightening inventory.

That means Detroit has something rare to offer both investors and homeowners alike: Opportunity in the form of low entry cost, high appreciation, and real community momentum, qualities few US markets are currently offering all at once.

Choosing the Right Strategy

Each of these five Detroit neighborhoods to watch in 2025 has its own distinct personality, but your success as an investor depends on choosing the right market for your own personal bottom-line.

In summary:

Regent Park and Warrendale are best for first-time investors or those looking for low-cost flips and rentals.

North Rosedale Park is an ideal avenue for experienced investors with larger budgets seeking high-end flips or luxury rentals.

Morningside is good flip territory near Grosse Pointe for upwardly mobile young professionals.

And Bagley is great for mid-to-large renovations with strong resale comps and steady student rental demand.

Final Word

Detroit isn’t just making a comeback – it’s entirely redefining itself.

In 2025, the city offers investors affordability along with steady growth.

Whether you’re chasing your first fix in Regent Park, premium appreciation in North Rosedale Park, or long-term Bagley charm – there’s room for virtually every strategy and budget.

If you can look beyond bleak narratives, Detroit offers something few other markets can: room to improve, room to profit, and room to build something long term.

Please check your email for your login details.

Please check your email for your login details.